Plus500, Well Regulated Broker

| Name | Plus500 |

| Regulation | Yes |

| Demo Account | Yes |

| Minimum Deposit | 100$ |

| Owners | Plus500 Ltd |

| Adress | Plus500UK Ltd, 78 Cornhill | London EC3V 3QQ |

| Overall Rating | |

| |

|

*Note: ‘80.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.’

Plus500 Overview

Plus 500 is a regulated CFD’s broker that was established in 2008. Plus500 is one of the largest companies in the world, a trader with a Plus500 account can trade CFD’s on Forex, Stocks, Commodities, Options(not Binary Options), and Indices. The highest leverage offered by Plus500 platform’s maximum leverage is up to 1:30, this leverage level may vary depending on the particular financial instruments.

Plus 500 offers an easy to use web platform, or the Android, IOS, Windows apps, Plus500 is available in more than 60 countries and is supported by 32 different languages.

In today’s hectic daily routine, Plus500 traders know they can keep trading wherever they may be. Plus500 offers application platforms for a full range of mobiles and tablets, especially for the busy trader.

In addition, Plus500 is regulated in more than 5 countries.

No negative balance – Unlike other brokers, with Plus500, customers cannot lose more than the funds they have available on their account.

Opening a demo account is very simple, with only Email adress and password. No download needed.

Regulation

At TradeProperly we believe that Regulation & license are the most important factors that needed to be considered, we are happy to see that Plus500 is a well-regulated broker, with 7 different regulations:

- Plus500UK Ltd is authorised and regulated by the FCA(Financial Conduct Authority FRN 509909).

- Plus500CY Ltd is authorised and regulated by the CySEC(Cyprus Securities and Exchange Commission Licence No. 250/14).

- Plus500AU Pty Ltd AFSL #417727 issued by ASIC(Australian Securities and Investments Commission).

- Plus500SG Pte Ltd (UEN 201422211Z) holds a capital markets services license from the MAS(Monetary Authority of Singapore for dealing in securities and leveraged foreign exchange trading License No. CMS100648-1) and a Commodity Broker’s License (License No. PLUS/CBL/2018) from Enterprise Singapore.

- Plus500AU Pty Ltd (ACN 153301681), licensed by ASIC in Australia, AFSL #417727, FMA in New Zealand (FSP No. 486026) Authorised Financial Services Provider in South Africa FSB (#47546)

- Plus500IL Ltd is a company registered in Israel, licensed to operate a trading platform from the ISA(Israel Securities Authority).

*Plus500 does not offer accounts to US residents.

Who is Plus500 For?

Plus500 is for everyone.

Seriously, it’s very simple to use their platform, from new investors to experienced ones. In our opinion, the platform is rich with a wide variety of tools combined with a comfortable user-friendly view.

Tools & Training

Plus500 offers a demo account which you can learn with and get experience with online trading, it’s highly recommended to start with the demo account before trading with real money. We couldn’t find any E-books or glossary on www.Plus500.com.

*If you don’t have any experience with trading online, It’s recommended to read “How To Trade Forex Online”.

What we do find is very useful tools such as:

- Risk Management Tools

- ‘Close at Profit’ [Limit] or ‘Close at Loss’ [Stop loss] rates – ‘Close at Profit’ [Limit] and ‘Close at Loss’ [Stop Loss] orders can be added to your trades when opening a new position/pending order, or when editing an existing position. These orders allow you to set a specific rate at which your position will close, in order to protect your profit, in the case of Close at Profit order or minimize your loss, in the case of Close at Loss order. Note that Close at Profit and Close at Loss orders do not guarantee your position will close at the exact price level you have specified. If the market price suddenly gaps down or up, at a price beyond your stop level, it is possible your position will be closed at the next available price which can be a different price than the one you have set. This is known as ‘Slippage’.

- Guaranteed Stop – Adding a Guaranteed Stop order to your trading position puts an absolute limit on your potential loss. Even if the price of the instrument moves significantly against you, your position will automatically be closed at the specified price, with no risk of Slippage. Guaranteed Stop is available for some instruments only. If an instrument supports the Guaranteed Stop order, a checkbox will be available for use in the platform (after you select the ‘Close at Loss’ checkbox).Guaranteed Stop details:A Guaranteed Stop can only be activated/edited when the instrument is available for trading. Once your Guaranteed Stop order is active, it cannot be removed, only a Close at Loss order can be amended/removed.The additional spread charge for a Guaranteed Stop is non-refundable once activated and will be displayed before approval. The level of the Guaranteed Stop must be at a certain predefined distance away from the current trading price of the instrument.

- Trailing Stop – Placing a Trailing Stop order helps you lock in a certain amount of profits. When you open a position or pending order with a Trailing Stop, it will remain open as long as its price moves in your favor, but will automatically close if its price changes direction by a specified amount of pips*.Trailing Stop allows you to place a Close at Loss order which automatically updates when the market moves in your favor. The Close at Loss order is activated if the market moves unfavorably (in accordance with the requested pips change). This feature is free of charge, however there is no guarantee that your position will close at the exact Close at Loss level, because of ‘Slippage’.

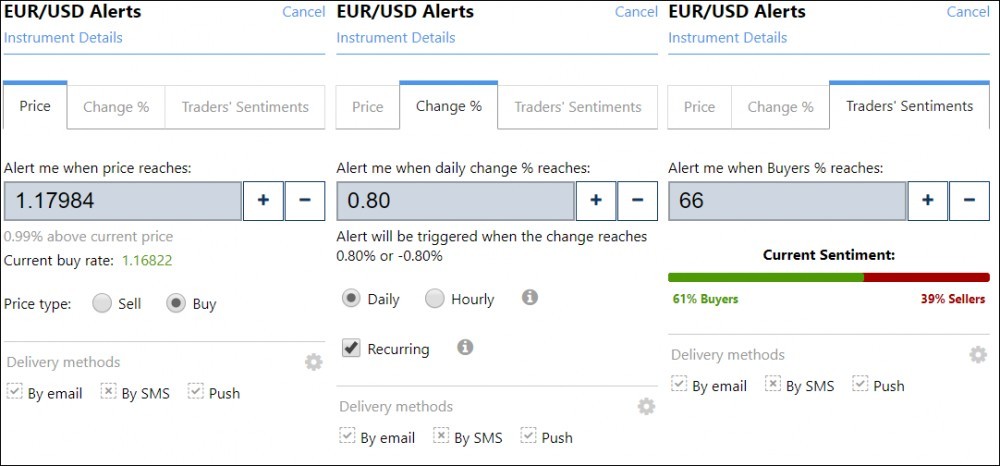

- Alerts – Get real-time email, SMS and push notifications based on:

- Price Alerts – Set Price alerts to get informed when an instrument reaches a specific Buy or Sell price.

- Change % (Daily or Hourly) – Use Change% alerts to get notifications when an instrument’s absolute price change (positive or negative) reaches a certain level. Change% alerts can also be configured to recur on a daily or hourly basis.

- Traders’ Sentiments (Buyers % vs. Sellers %) – The Traders’ Sentiments is a unique notification tool which is automatically triggered when the percentage of Buyers or Sellers (among Plus500 customers) reaches a certain level.

Platform & Assets

Plus500 use’s a web-based platform that we found pretty easy to use with a very wide amount of options, we find it possible to adjust everything we needed.

- 7 Different chart styles.

- 95 Available indicators(!).

- 15 Drawing tools.

This is how a trading platform of serious broker should look like.

The platform is available also for smartphones such as Android, IOS, Windows and Windows 10 Trader app that is even more advanced for traders who want to use it.

Plus500 platform offers many assets to trade on such as:

- Forex

- Commodities

- Indices

- Options

- ETF’s

- Shares

- Cryptocurrencies

Support

The customer support online chat available 24/7, or contact through Email by leaving a message at “contact us” page.

Also, you can find under their FAQ page, answers to major questions.

TradeProperly Final Opinion of Plus500

With an amazing platform, a huge variety of assets to trade on, many useful tools and indicators.

In addition to 7 different countries regulations, we are highly recommended Plus500!

Remember, regulation is for you and will protect you from scams.

Regulation

Assets

Tools & Training

Platform

Experience

Beginners Friendly

Do you have any kind of experience with this broker? Want to share your opinion? Please share your opinion by commenting below, let us know if you found this article useful or if you have any questions.

I have never heard of this before. I have had very little experience with type of thing and feel more educated on it after reading your post .I think i have learned a little bit more about the online world from your detailed information but I will definitely be back to read more of your reviews Thankyou.

Hi Cass,

Feel free to check our Education page for more helpful information about trading online.

No negative balance is a big one! Haha, I’m been scammed once as I quite carelessly gave away my credit card once. Interesting to read that it doesn’t offer to US residents. Does it offer to everyone else? I’m always hesitant to get on board with trading as I feel like there is a chance for me lose a lot of money. I lost over $200 in about 2 hours when I first tried it so I never feel safe.

Hi Parmi,

No negative balance is a big advantage, unfortunately, plus500 do not accept client fro the U.S.

Plus500 is regulated in the Europe Union(Cyprus), Austalia, United Kingdom,

New Zealand, South Africa, Singapore, Israel and they do accept traders from other countries as well.

Hi. It is fascinating to see how many amazing tools are available to traders and they seem to be increasingly sophisticated. This seems to allow a lot of analysis and real commercial characteristics. Am I understanding correctly?For those beginner ,do you have any suggestion on new tips &source; that you would provide?

Hi, the first tip is to check if the broker is regulated or not, then you can check our education page that includes many useful articles for beginners.

And a very important tip is to stay up to date with the latest news about economies and big companies that you can trade on their shares.

I’ve been looking at getting into trading but was always wondering a bit about how not to loose too much money while learning the whole thing.

Some other people who have been trading for a long time lost a lot of money and gave me the basic advice that if you can’t afford to loose that kind of money, don’t invest it.

So seeing this company and reading that you can’t lose more than the funds you have in your account. And that you can start with as little as $100. Worth looking into it. Thanks for sharing.

Hi Petra, that called negative balance protection, nowadays, there are new regulation roles that protect and helps the trader.

Hey i really enjoyed this article, it was very interesting. I have messed with some stocks before but not for very much. It seems like this app or program is very easy to use but im not sure if i would want to try an put a lot of oney into a stock when there is a high chance i could lose it. maybe sometime in the future when i am making good enough money i can part with some. But really good review keep it up!

Hi Justin, Thank you for the support!