This week starts as the NFP(non-farm payroll) published on Friday, came out positive while the Average Hourly Earnings m/m and the Unemployment Rate came out negative, pushing the U.S Dollar down and gaining strength for the Stocks EUR, GBP, Gold, Silver…

As the trade war started officially between Thursday to Friday investors seem to not be too concerned about rising Geo-Political risks, and continued to purchase stocks after Friday’s outcomes.

Asia rallies after Friday’s strong close of the session as the Nikkei goes up by 1.22%/Shanghai 2.15%/Hong Kong 1.91% and markets are taking a breather from most of the previous week – https://uk.reuters.com/article/us-global-markets/asia-rallies-on-u-s-jobs-relief-pound-pinched-by-politics-idUKKBN1JY12P

JPMorgan published a list of currencies that will be valid in case of a recession, check it out here – https://www.bloomberg.com/news/articles/2018-07-09/jpmorgan-maps-out-currencies-to-buy-if-a-recession-is-coming

As inflation concerns continue to rise, the trade war continues to escalate between U.S/China/EU investors are looking for new pieces of news on daily basis to get a clue on future patterns of behavior from world leaders – more to come that’s for sure…

S&P500 – Looks like facing a resistance level, which if it will be breached, it will lead towards a test of previous resistance level, and if it will not, then a pullback back towards 2,700 will be very logical.

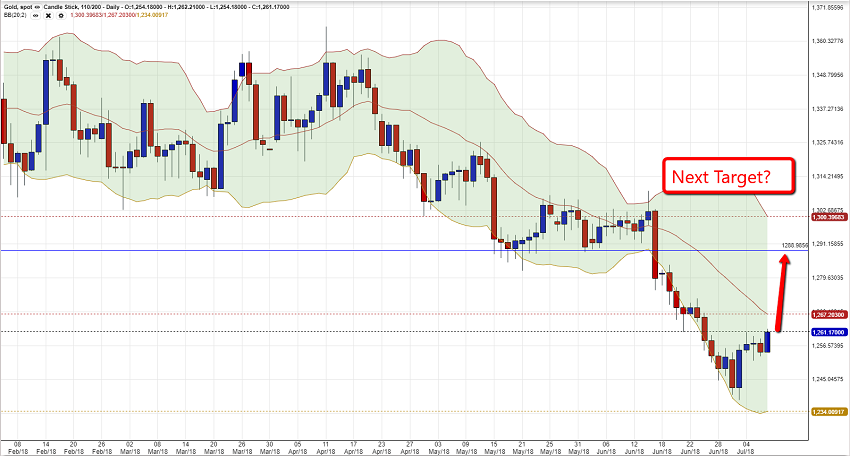

When Inflation concerns are back in the market, then the weapon against it was and still is – Gold/Silver.

Gold – As the U.S Dollar gets weak, the Gold gets stronger, and now moving towards the 1,280 level to test it…

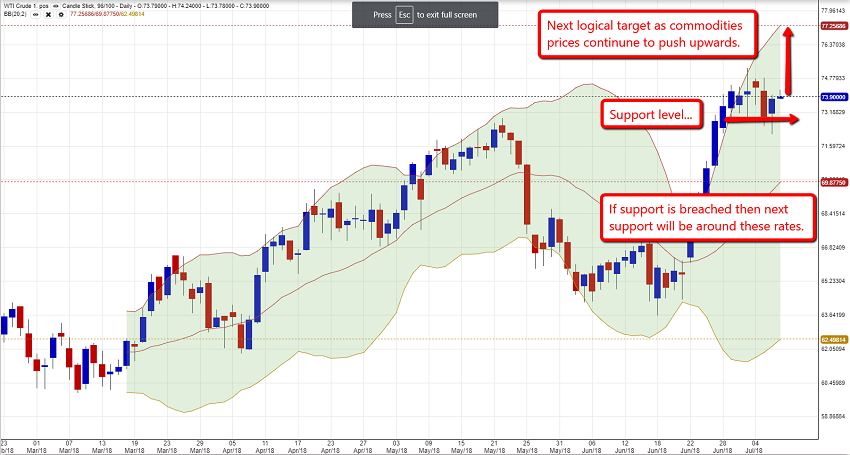

Crude Oil – maintains strength, and continues to push up even though OPEC member Saudi Arabia declared will increase production of Oil by more than 1M per day.

As of now, the support level is located around 72.8$ per barrel – if the support level breached it will visit rates of 70$ per barrel again – if it will hold then next rate will be around 77$ per barrel.

Share your opinion below, and stay tuned – more to come…