The Big Short

The market is always surprising, exciting – delivering!

As the earnings season picks up and provided movements like Facebook that went down by 19%, Amazon raised up after hours by 3.18% – and it’s not over yet…

During this time, slowly but surely the Indices are climbing towards new highs and are providing an interesting view over a very known and familiar film from 2015 – “The Big Short”

Is no one paying attention to the fact that the market is climbing towards new All Times High? Is anyone paying attention to the fact that the expected GDP Q/Q is at 4.2% Vs previous 2%? – https://www.forexfactory.com

Does an economy like the U.S one considered to be healthy when Tax plans are stimulating an already stimulated economy? Is it really a healthy growth pace? what will happen when the effect of the Tax plan will wear off? What will happen when the Federal Reserve bank will increase interest rates again+reduce 50B on monthly basis? Where will currencies of growing economies(Such as China, Russia, Turkey, South Africa, Brazil) be then?

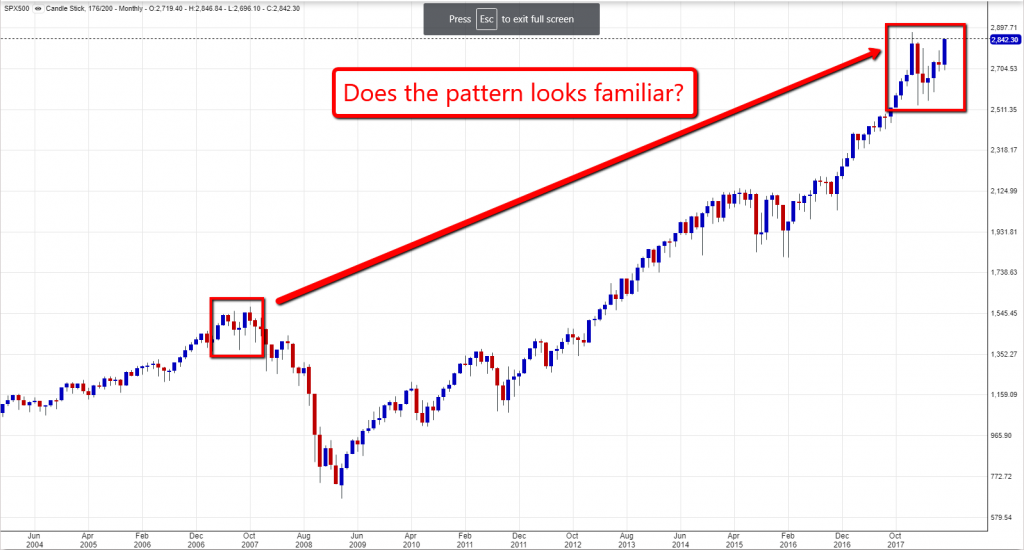

This is how the S&P500 is looking right now:

This is how the Nasdaq looks like right now:

Let’s ask several questions and by the answer, we will know what to do:

Do we believe the market will go up forever?

How far do we think the market will go?

Suppose we believe the market will go up – how many contracts will we want to buy?

Suppose we believe the market will drop eventually…If we had the ability to go back in time to 2007 – how many contracts will we take against the Index?

Answer these questions to yourself – and find your position in the market – then ask yourself how much are you willing to expose…

Stay tuned – And share your opinion below…