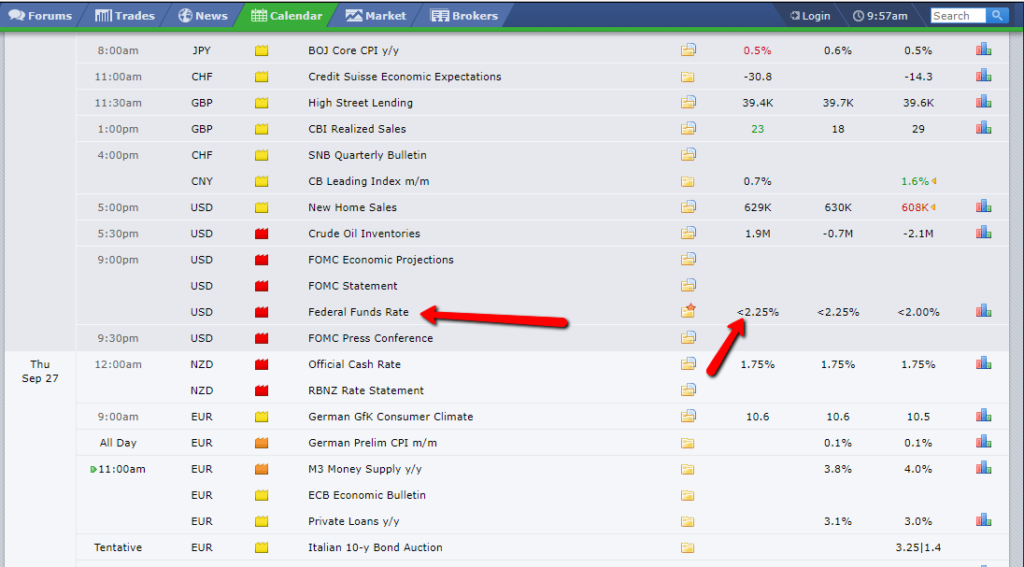

Yesterday the Interest rate in the U.S went up for the 5th time since the hikes began and by the looks of it – it’s not over just yet…

Yesterday the Interest rate in the U.S went up for the 5th time since the hikes began and by the looks of it – it’s not over just yet…

The Federal Open Committee raised interest towards 2.25% and the statement which came 30 minutes after showed that the majority of the members support an additional rise in December and 3 more during 2019 – how did the market take it? – let’s see…

EUR/USD – started a movement of 93 pips down and looks as if heading towards upcoming support level at 1.1661 – and if breached can go all the way towards next support at – 1.1529

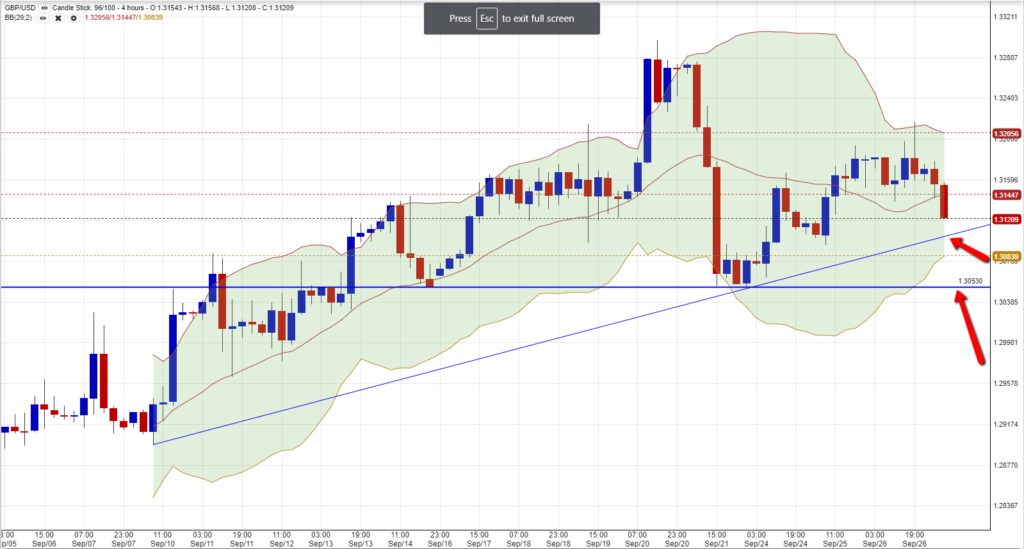

GBP/USD – going towards 80 pips down and facing upcoming support level at 1.3053 as the Dollar continues to grow strong – the “Cable” will continue to suffer weakness…

Gold – this commodity which is traded against the Dollar is suffering a negative momentum for a long time now and if the upcoming support levels are breached we are facing the possibility of rates stated on the chart below – follow the price action!

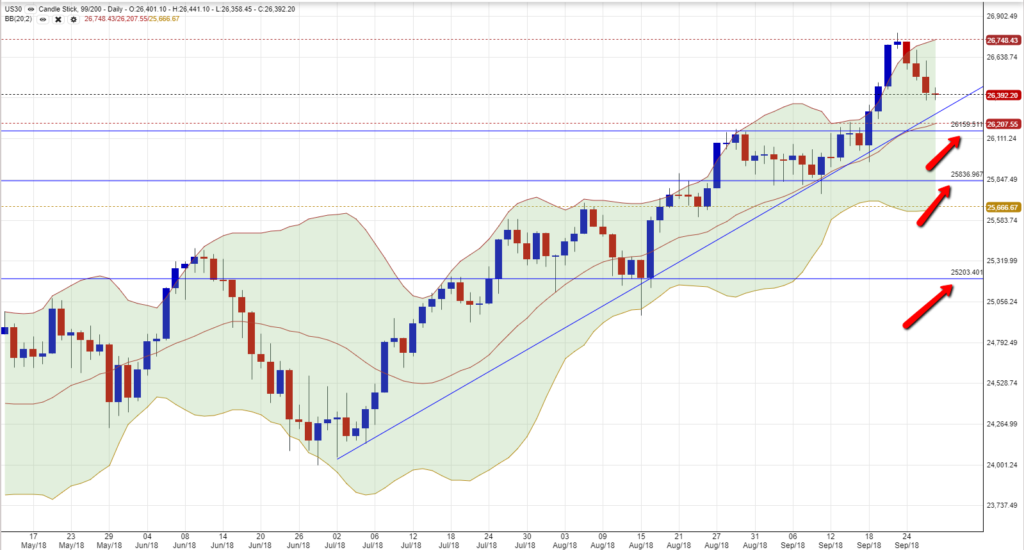

Last but not least – Indices – and we will go on the Dow Jones for today…

As October nears and many analysts are talking about a bad month for stocks – (https://www.marketwatch.com/story/should-investors-fear-october-a-historic-jinx-month-for-stocks-2018-09-26) it looks like the market started pricing it in – although the index is still traded around all times high it is important to follow the rates below:

Comment below and stay tuned – more to come…