The new tariffs influence

Recently we heard about several actions the U.S administration started implementing on the Chinese market, one with more countries such as Canada/Mexico/U.K/EU/Russia/Iran/Turkey/Japan – suffering new tariffs and an ongoing concern from using economic sanctions as leverage against free trading agreements such as NAFTA/TPP etc…

So far it looks like the U.S has the upper hand as currencies around the world are dropping against the Dollar and no end in sight…

![]()

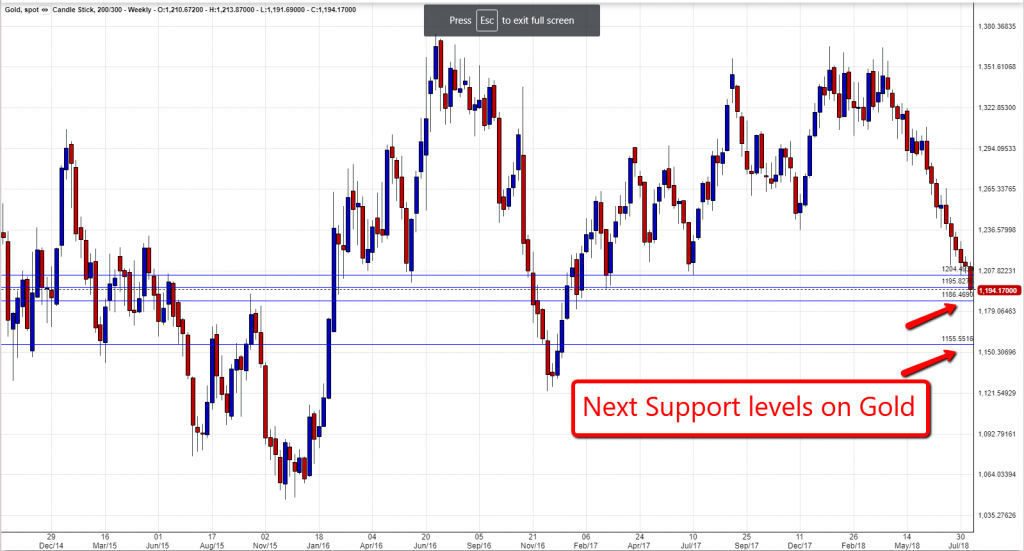

Gold

As yesterday we showed on our market review – the situation just got even worse as the Gold started a decent yesterday of up to 20$ in value and looks like this:

As of now due to the strength of the dollar, it is expected the commodity will continue being weak as long as the U.S currency will keep on climbing…

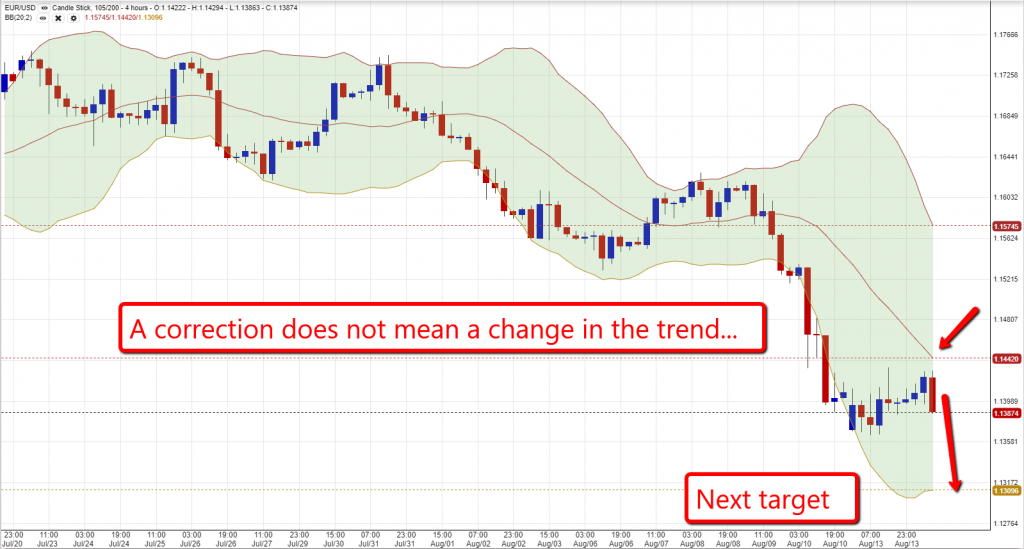

Major currency pairs

EUR/USD – Looks very bearish and continues to drop as looks right now going towards support level at 1.3090.

GBP/USD – Does not untouched as the strong dollar effects the cable as well.

China and U.K markets

It is expected to see some shaky times in the markets as they go into a fluctuation faze as it reaches all times highs and hesitation of investors is felt as other markets are showing weakness signs all over the world…here is just a taste of what is happening:

Shanghai SE – Chinese market is in the bear’s territory as dropped more than 24% and the new tariffs from the U.S don’t contribute to the safety of investors…

FTSE – Looks in the past several weeks as if does not have a direction as the fluctuations appear very obvious on the chart below…

Share your opinion below and stay tuned – more to come…