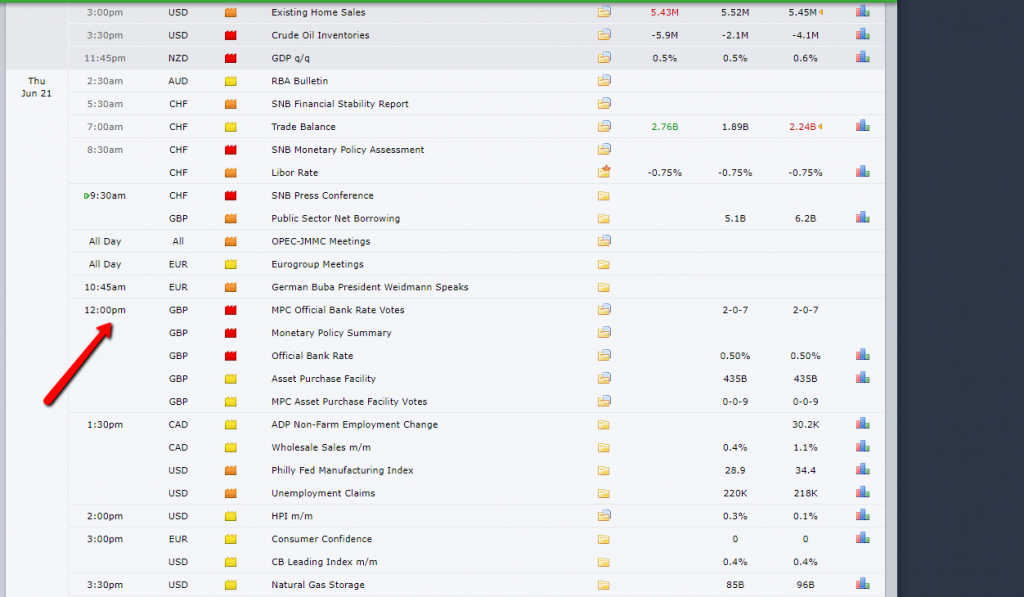

Today we have the interest rate decision by the bank of England with the monetary policy – which will affect the GBP and create volatility in related assets.

As tension around the trade war escalates – the markets become indifferent to it every day that goes by…

The European Union stated yesterday Tariffs for a 34B amount on the U.S and it looks like the “Talk becomes a walk’…- we will have to wait and see how it develops.

In the meantime, daily announcements from billionaires around the world that warn form a lurking recession concern, and are providing headlines of bears predictions – you can decide if it is talking from a position or an actual opinion – https://www.marketwatch.com/story/hedge-fund-boss-who-predicted-87-crash-says-next-recession-will-be-really-frightening-2018-06-19

At 12:00GMT the announcements will take place – follow the price action.

Also, follow the announcements in real time – https://www.forexfactory.com

Dollar Index

The Dollar Index is reaching a critical point where it will breach it and stabilize around it we are facing a long-term up rise on it towards 100-103 – please follow the attached chart.

In an era of rising interest rates and weakness of almost every other currency rate – the strength of the U.S Dollar seems to be quite safe to assume…

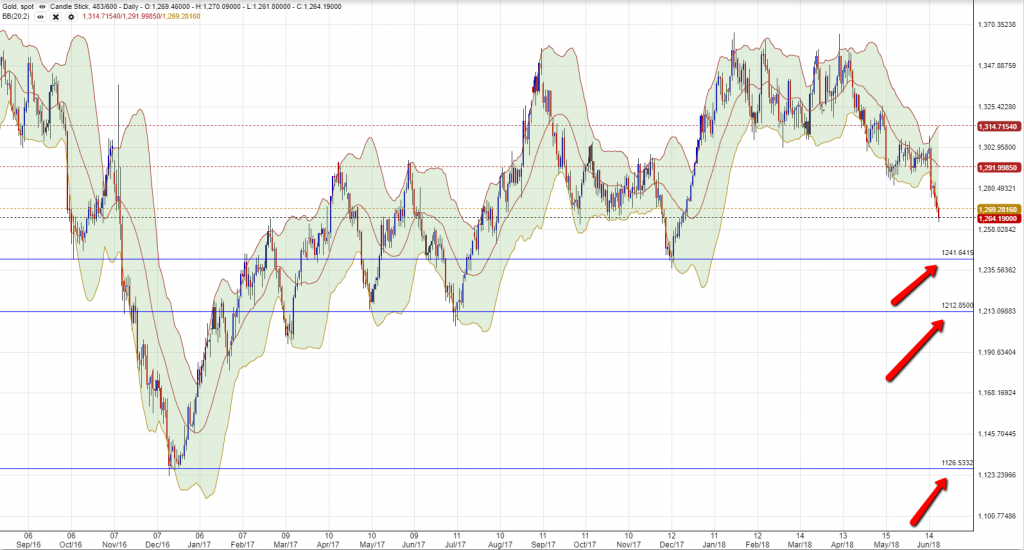

Gold

Gold – due to a strong dollar, the Gold suffers from negative momentum in the past 5 trading sessions, and as long as the dollar gets stronger the Gold will most likely stay bearish.

According to technical the upcoming support levels of the Gold are stated on the attached chart:

Share your opinion below, and stay tuned – more to come.