The market looks like there are recently more sellers than buyers.

As indices started the session yesterday with a significant uprise – finished it descending up to 1.5% and suffering from the biggest turnaround since February…

China and the U.S

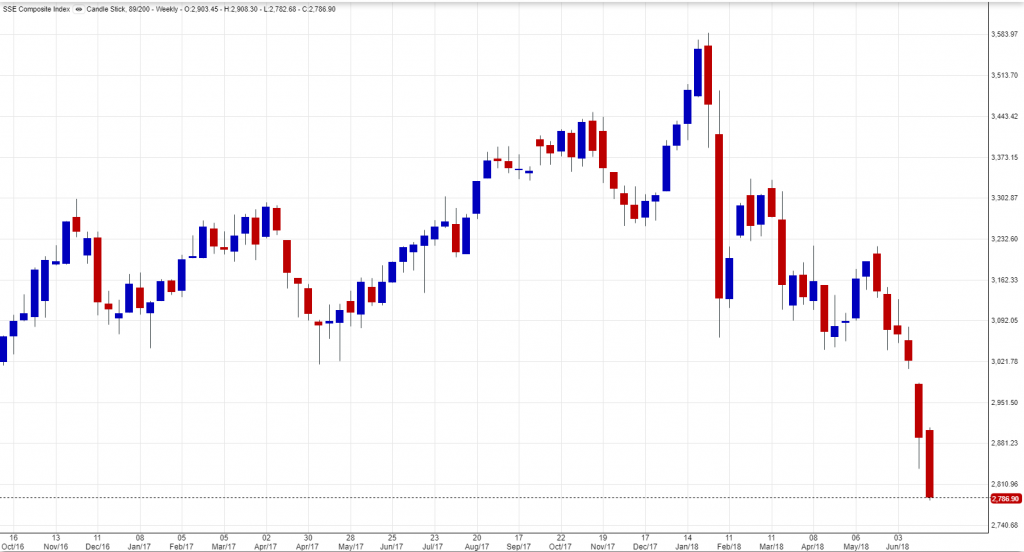

The Chinese market went into the Bear territory after yesterday’s close as the 20% mark was breached and Shanghai closed yesterday at 21% distance from the previous pick at 3,583$ and as the Chinese currency continues to lose his strength against the U.S Dollar – it is turning interesting…

The fact that the second economy in the world is in a bearish market – will that affect the number 1 economy in the world? – let’s wait and see…

The chart below tells the story of China

The chart below describes the situation of the U.S market

So far, the 2 economies are somewhat correlated and are risking the amazing run of the Bullish market of the past 10 years – The trade war between the 2 economies, do not really contribute to calm down the markets – investors will still need to follow the price actions and news, tweets, tariffs, peace agreements, European Zone, Bailouts, Rescue packages, Interest rates hikes etc…

FAANG – Yesterday, these stocks also suffered from a negative momentum, as these stocks started the day with a significant increase and finished it down.

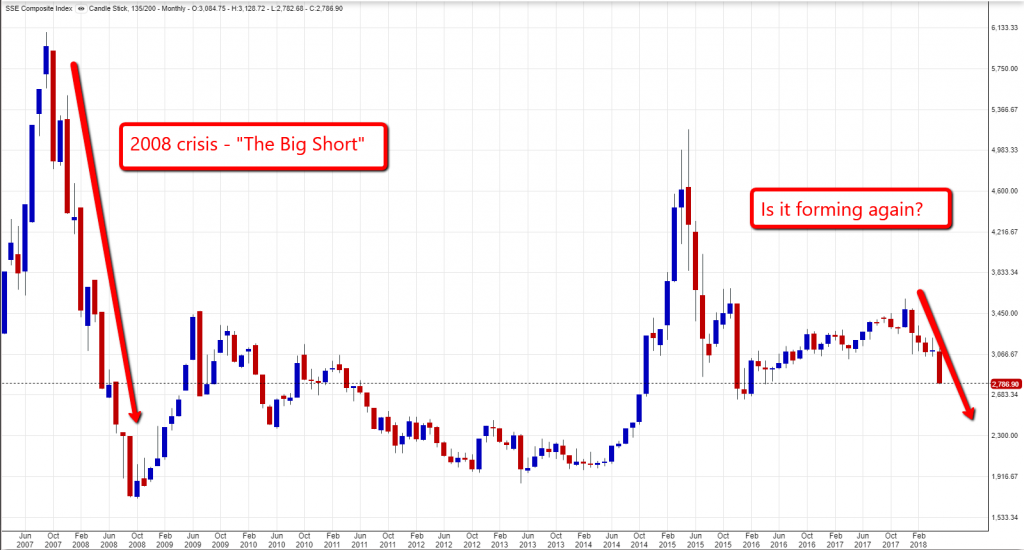

Let’s see what happened in 2008 on several assets and compare it to what is happening now, shall we?

Gold – This is how the gold looked like back then right after the crisis erupted – right before started an amazing movement of 1,000$ per ounce in the month to follow.

And this is how the Gold looks like today…- you decide.

Look at the Chinese market back then – and now.

Now, look at the American market that is enjoying a 9 year Bull market.

Now look at the EUR/USD – and think if 2008 can happen again?

The decision whether we are a minute before another world crisis can be decided only individually – but watch the signs – some of them are already here…

Stay tuned – more to come…